Business

The Benefits and Challenges of Investing in Renewable Energy for Business

Investing in Renewable Energy

USPA NEWS -

Discover the advantages and disadvantages of investing in renewable energy for your business, including cost savings, tax credits, and revenue potential. Learn about on-site renewable energy generation, virtual power purchase agreements, and trading renewable energy credits.

I need a headline brief, a teaser and keywords (comma separated) for the story below:

As a business leader, it is important to carefully consider the potential impact of investing in renewable energy. There are both advantages and disadvantages to investing in renewable energy, and it is essential to weigh these carefully before making a decision.

One of the biggest advantages of investing in renewable energy is the potential for cost savings. Renewable energy technologies, such as solar panels and wind turbines, can provide a source of clean and sustainable energy for your business. Over time, this can help to reduce your reliance on fossil fuels and lower your energy costs. In addition, the cost of renewable energy has been decreasing in recent years, making it more affordable than ever before.

As a business leader, it is important to carefully consider the potential impact of investing in renewable energy. There are both advantages and disadvantages to investing in renewable energy, and it is essential to weigh these carefully before making a decision.

One of the biggest advantages of investing in renewable energy is the potential for cost savings. Renewable energy technologies, such as solar panels and wind turbines, can provide a source of clean and sustainable energy for your business. Over time, this can help to reduce your reliance on fossil fuels and lower your energy costs. In addition, the cost of renewable energy has been decreasing in recent years, making it more affordable than ever before.

There are several ways that your business can invest in renewable energy. For example, you can invest in on-site renewable energy generation, such as a solar panel system for your facility. This can provide a source of clean energy for your business and potentially qualify for investment tax credits or other incentives. The federal government offers a number of tax credits and other incentives for businesses that invest in renewable energy, including the solar investment tax credit and the production tax credit. These credits can help to offset the initial cost of investing in renewable energy technology, making it more affordable for your business.

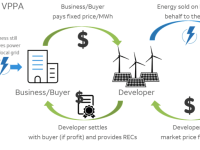

Another option is to participate in a virtual power purchase agreement (VPPA) with a renewable energy provider, in which you agree to purchase a specific amount of renewable energy at a fixed price over a certain period of time. This can help to hedge against future energy price increases and provide a predictable source of renewable energy for your business. Under a VPPA, the renewable energy provider typically sells the electricity generated by the project to the grid at the prevailing market price. If the market price is higher than the price you have agreed to pay for the renewable energy, the provider can make a profit. This profit can be shared with your business, providing an additional source of revenue.

In addition to investing in renewable energy directly, your business can also support the growth of renewable energy by trading renewable energy credits (RECs). RECs are a form of environmental commodity that represent the environmental attributes of one megawatt-hour of renewable energy. By purchasing RECs, your business can demonstrate its commitment to renewable energy and support the growth of the renewable energy industry.

RECs can be traded on various exchanges and over-the-counter markets, and the price of RECs can vary depending on supply and demand. By buying RECs at a lower price and selling them at a higher price, your business can potentially make a profit. However, it is important to carefully evaluate the market conditions and consider potential risks before making any investment decisions.

In conclusion, investing in renewable energy can provide a number of benefits for your business. It can help to reduce your energy costs, qualify for tax credits and other incentives, and potentially provide additional revenue through the sale of renewable energy or RECs. It can also improve your company's reputation and create jobs and stimulate economic growth in your community. However, there are also some disadvantages to consider, such as the initial cost and the reliability of renewable energy. As a business leader, it is important to carefully weigh the pros and cons before making a decision about investing in renewable energy.

Investing Renewable Energy Cost Savings Tax Credits Virtual Power Purchase Agreement Trading Renewable Energy Credits Environmental Commodity Revenue Potential

Liability for this article lies with the author, who also holds the copyright. Editorial content from USPA may be quoted on other websites as long as the quote comprises no more than 5% of the entire text, is marked as such and the source is named (via hyperlink).