Business

Debate On CONTROL OF FOREIGN INVESTMENT, in PARIS

November 13,Groupe Les Echos-Le Parisien

DEBATE ON CONTROL OF FOREIGN INVESTMENT - IN PARIS (Source: © Ruby BIRD & Yasmina BEDDOU)

USPA NEWS -

On November 13, 2018 was held a Debate on "Control of Foreign Investment" at Groupe Les Echos - Le Parisien Headquarters (Paris). It was organized by Capital Finance in Partnership with the Firm Goodwin Paris.

On November 13, 2018 was held a Debate on "Control of Foreign Investment" at Groupe Les Echos - Le Parisien Headquarters (Paris). It was organized by Capital Finance in Partnership with the Firm Goodwin Paris. As a Mechanism for Fostering Growth and increasing Shareholder Value, M&A is an Important Tool in a Company´s Armoury. Cross-Border M&A in Particular can be a Useful Springboard for those eyeing Expansion and Future Prosperity. Simply put, Expansion into a Foreign Market requires a Suitable Target to be identified, Effective Execution of a Transaction and Successful Integration of Converging Companies. That said, the Processes involved are not Simple, as they present Numerous Challenges and Pitfalls.

Additional Challenges impacting the Cross-Border M&A Space include the Emerging Trade War between the US and China and its Indirect Impact on Europe, Canada, Mexico and Latin America, among others, as well as the Nationalistic Trends permeating Politics, such as Recently Proposed Changes to Committee on Foreign Investment in the United States (CFIUS) Legislation. Given the Complexity of the Dealmaking Landscape, it is unsurprisingly that the Majority of Successful Cross-Border M&A Transactions tend to be based on Careful Advance Preparation, Well Thought-Out Strategies and Anticipatory Deal Structures.

Trade Protectionism is defined as a Nation, or sometimes a Group of Nations working in Conjunction as a Trade Bloc, creating Trade Barriers with the Specific Goal of protecting its Economy from the Possible Perils of International Trading. This is the Opposite of Free Trade in which a Government allows its Citizenry to purchase Goods and Services from other Countries or to sell their Goods and Services to other Markets without any Governmental Restrictions, Interference, or Hinderances. The Objective of Trade Protectionism is to protect a Nation´s Vital Economic Interests such as its Key Industries, Commodities, and Employment of Workers.

There are Various Methods of Trade Protectionism whose Goal is to protect a Nation´s Economic Well-Being. These include:

* Tariffs which are a Tax on Imports from other Countries and Foreign Markets.

* Quotas are a Direct Restriction on the Number of Certain Goods, Products, and Commodities that may be permitted to be imported into a Nation.

* Subsidies are Government Payments to Domestic Producers.

* Local Content Requirements may be imposed by a Nation seeking to decrease Imports by setting a Manufacturing Requirement in which a stated Part or Parts of a Product must be made Domestically.

* Administrative Trade Policies consist of Bureaucratic Rules, Laws, and Regulations designed to create Serious Difficulties for an Importer of Goods or Commodities into a Particular Nation.

* Antidumping Policies are enacted by a Nation in order to prevent the Selling of Goods in a Foreign Market at a Price far below their Production Costs in order to gain a Substantial Share of that Nation´s Market.

* Exchange Rate Controls can be used to make a Nation´s Product Cheaper abroad by lowering the Value of its Currency in the Foreign Exchange Markets.

* Tariffs which are a Tax on Imports from other Countries and Foreign Markets.

* Quotas are a Direct Restriction on the Number of Certain Goods, Products, and Commodities that may be permitted to be imported into a Nation.

* Subsidies are Government Payments to Domestic Producers.

* Local Content Requirements may be imposed by a Nation seeking to decrease Imports by setting a Manufacturing Requirement in which a stated Part or Parts of a Product must be made Domestically.

* Administrative Trade Policies consist of Bureaucratic Rules, Laws, and Regulations designed to create Serious Difficulties for an Importer of Goods or Commodities into a Particular Nation.

* Antidumping Policies are enacted by a Nation in order to prevent the Selling of Goods in a Foreign Market at a Price far below their Production Costs in order to gain a Substantial Share of that Nation´s Market.

* Exchange Rate Controls can be used to make a Nation´s Product Cheaper abroad by lowering the Value of its Currency in the Foreign Exchange Markets.

Regarding FRANCE, The Action Plan for Business Growth and Transformation (PACTE) aims to empower Businesses to Innovate, Transform, Grow and create Jobs.The PACTE Bill, presented on June 18 to the Cabinet, contains a Total of 70 Articles, Ten of which are geared towards Better Financing Businesses, giving them Greater Freedom and making them both Fairer and more Innovative. But what Responsibilities will Businesses now have when it comes to the Demands and Needs of Contemporary Society ? Will their Societal Role undergo a Complete Overhaul after the Vote, or will the Process be more Gradual ?

As of Today, in France, the Existing Framework sets out a Procedure for controlling Foreign Investments in Eleven Sectors. Foreign Investments in these Sectors are subject to the Prior Authorization of the State. The PACTE Bill expands the List of Strategic Sectors which now includes the Semiconductors Production, Space, Drones, Artificial Intelligence, Cybersecurity, Robotics, and Big Data. Until now, the Strategic Sectors targeted by the Decree have concerned, Inter Alia, the Gambling Industry (excluding Casinos), Private Security Services, Counter-Terrorism, Wiretapping, IT, National Security Secrecy, Cryptology, Weapons, Energy, Public Health, Transport and Telecommunications.

CFIUS is an Interagency Committee authorized to review Certain Transactions involving Foreign Investment in the United States (“Covered Transactions“), in order to determine the Effect of such Transactions on the National Security of the United States. The Secretary of the Treasury is the Chairperson of CFIUS, and notices to CFIUS are received, processed, and coordinated at the Staff Level by the Staff Chairperson of CFIUS, who is the Director of the Office of Investment Security in the Department of the Treasury. The National Security Landscape has shifted in Recent Years, and so has the Nature of the Investments that pose the Greatest Potential Risk to National Security, which warrants an Appropriate Modernization of the Processes and Authorities of the Committee On Foreign Investment in the United States and of the United States Export Control System.

While the Trump Administration has been firm in its messaging that FIRRMA is meant to "Close Gaps" between the Transactions that CFIUS is currently able to review and Transactions it currently cannot review despite them raising Similar National Security Concerns, the Reality is that those "Gaps" largely pertain to Particular Chinese Investment Trends :

* Real Estate Acquisitions in Sensitive Areas,

* Minority Investments (particularly through Private Equity-Type Structures) that might not be controlling but that nonetheless provide Access to Sensitive Information or Technology of the Target US Business,

* The Increasing Use of Chinese Joint Ventures into which US-Origin Technology is transferred,

* Concerns that Chinese Deals are being structured to circumvent CFIUS.

--- )) FIRRMA provides the General Contours for CFIUS Reform, but not the Specifics.

* Real Estate Acquisitions in Sensitive Areas,

* Minority Investments (particularly through Private Equity-Type Structures) that might not be controlling but that nonetheless provide Access to Sensitive Information or Technology of the Target US Business,

* The Increasing Use of Chinese Joint Ventures into which US-Origin Technology is transferred,

* Concerns that Chinese Deals are being structured to circumvent CFIUS.

--- )) FIRRMA provides the General Contours for CFIUS Reform, but not the Specifics.

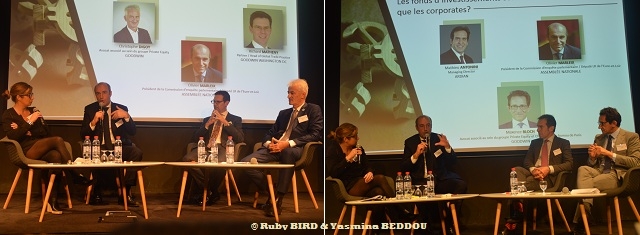

DEBATE On "Control of Foreign Investment" :

- (1*) How France is positioning Itself on the Board of Control Of Foreign Investment

Animated by Emmanuelle DUTEN, Chief Editor Les Echos-Capital Finance

* Christophe DIGOY, Associate Lawyer, Private Equity Group Goodwin

* Olivier MARLEIX, President of the Parliamentary Inquiry Commission, LR Deputy of Eure-et-Loire, National Assembly

* Richard MATHENY, Partner, Head of Global Trade Practice Goodwin Washington DC

- (1*) How France is positioning Itself on the Board of Control Of Foreign Investment

Animated by Emmanuelle DUTEN, Chief Editor Les Echos-Capital Finance

* Christophe DIGOY, Associate Lawyer, Private Equity Group Goodwin

* Olivier MARLEIX, President of the Parliamentary Inquiry Commission, LR Deputy of Eure-et-Loire, National Assembly

* Richard MATHENY, Partner, Head of Global Trade Practice Goodwin Washington DC

- (2*) Are the Investment Funds as much threatened as Corporates ?

Animated by Emmanuelle DUTEN, Chief Editor Les Echos-Capital Finance

* Mathieu ANTONINI, Managing Director Ardian

* Maxence BLOCH, Associate Lawyer Private Equity Group Goodwin and Chair of Paris Office

* Olivier MARLEIX, President of the Parliamentary Inquiry Commission, LR Deputy of Eure-et-Loire, National Assembly

Source : Debate "Control of Foreign Investment" on November 13, 2018 @ Groupe Les Echos - Le Parisien Headquarters (Paris)

Ruby BIRD

http://www.portfolio.uspa24.com/

Yasmina BEDDOU

http://www.yasmina-beddou.uspa24.com/

Animated by Emmanuelle DUTEN, Chief Editor Les Echos-Capital Finance

* Mathieu ANTONINI, Managing Director Ardian

* Maxence BLOCH, Associate Lawyer Private Equity Group Goodwin and Chair of Paris Office

* Olivier MARLEIX, President of the Parliamentary Inquiry Commission, LR Deputy of Eure-et-Loire, National Assembly

Source : Debate "Control of Foreign Investment" on November 13, 2018 @ Groupe Les Echos - Le Parisien Headquarters (Paris)

Ruby BIRD

http://www.portfolio.uspa24.com/

Yasmina BEDDOU

http://www.yasmina-beddou.uspa24.com/

Yasmina Beddou Groupe Les Echos Le Parisien Auditorium Conference November 13 Debate 2018capital Finance Control Of Foreigh Investment Ruby Bird

Liability for this article lies with the author, who also holds the copyright. Editorial content from USPA may be quoted on other websites as long as the quote comprises no more than 5% of the entire text, is marked as such and the source is named (via hyperlink).